Adjustable Rate Mortgage is fixed for the first seven years. This product has a 30-year amortization and requires 84 monthly payments of $3,537, followed by 276 monthly payments of $3,449. With an ARM loan, the rate is variable and may increase or decrease every 6 months after the initial fixed rate period based on changes to the index.

The monthly payments shown do not incldue amounts for taxes and insurance premiums, so the actual payment obligation may be greater. Rates shown assume standard mortgage qualifications, underwriting requirements, and Automatic Payment discount. For adjustable-rate mortgages, the discount is applicable only during the initial fixed-rate period. All terms and conditions applicable to the checking or savings account apply, including fees and minimum opening deposits.

Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $800,000, 80% loan-to-value, and minimum 740 FICO score. These rates are intended for informational purposes and are not an offer to extend consumer credit. The 30-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. The monthly payments shown do not include amounts for taxes and insurance premiums, so the actual payment obligation may be greater.

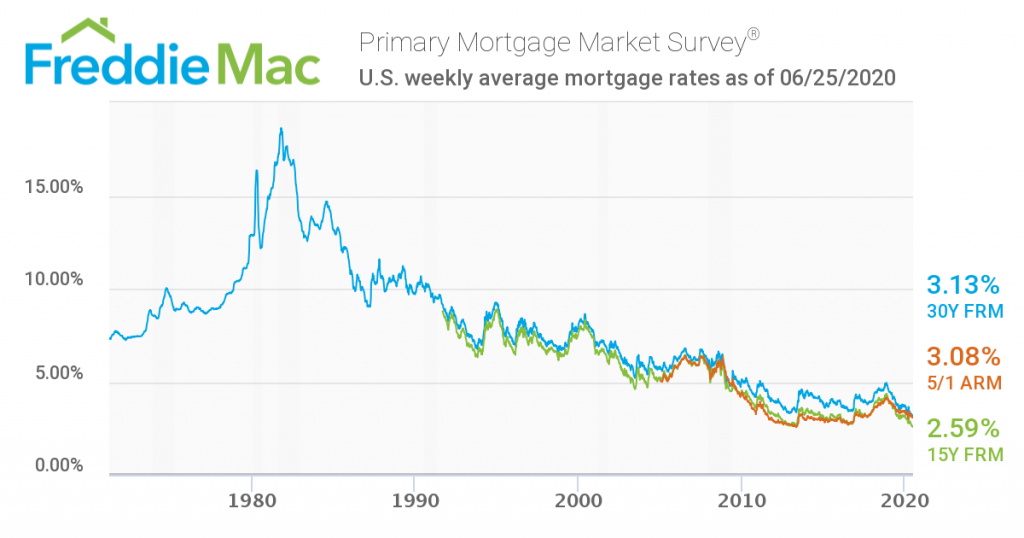

Example based on refinance of owner-occupied, one unit, single family residence in Los Angeles, California with a loan amount of $250,000, 80% loan-to-value, and minimum 740 FICO score. The 15-Year Fixed Mortgage provides for fixed, fully amortizing principal and interest payments for the life of the loan. Mortgage rates vary depending upon the down payment of the consumer, their credit score, and the type of loan that will be acquired by the consumer. For instance, in February, 2010, the national average mortgage rate for a 30 year fixed rate loan was at 4.750 percent (5.016 APR).

The 15 year fixed was at 4.125 percent (4.312 APR) and the 5/1 ARM was at 3.875 percent (3.122 APR). These prices are just a snapshot of the average and will constantly change day to day, though the relative values will remain roughly the same. Namely, longer duration debt & fixed rate loans are typically charged a higher initial interest rate to lock in the certainy.

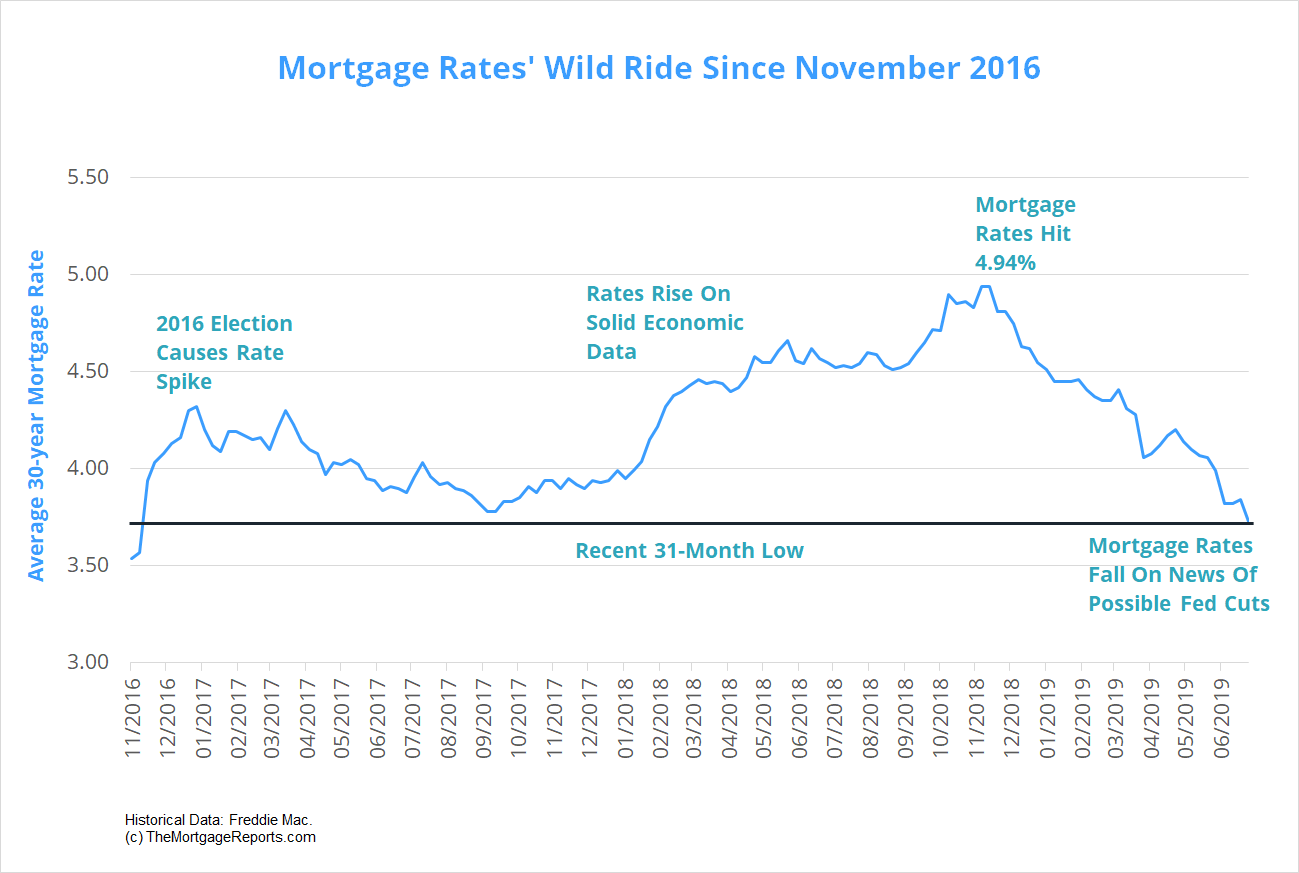

You should consider refinancing your home loan if your current mortgage rate exceeds today's mortgage rates by more than one percentage point. Mortgage refinance fees and closing costs would cut into your savings. You also have to consider whether your credit score would qualify you for today's best refinance rates. That's all to say that if you take advantage of the savings offered by refinancing, you're ahead of the personal finance curve.

But it's only worth doing if you'll actually save money in the process. Before you decide to take the plunge, take a look at current refinance rates and compare them to the rate you're currently paying. Then play around with our refinance calculator and see whether refinancing makes sense for you. Chart data is for illustrative purposes only and is subject to change without notice. Advertised rate, points and APR are based on a set of loan assumptions . Chart accuracy is not guaranteed and products may not be available for your situation.

Monthly payments shown include principal and interest only, and , any required mortgage insurance. Any other fees such as property tax and homeowners insurance are not included and will result in a higher actual monthly payment. Advertised loans assume escrow accounts unless you request otherwise and the loan program and applicable law allows. Should you choose to waive escrows, your rate, costs and/or APR may increase. Select the About ARM rates link for important information, including estimated payments and rate adjustments.

This information is being provided for informational purposes only and is neither a loan commitment nor a guarantee of any interest rate. If you choose to apply for a mortgage loan, you will need to complete our standard application. Our loan programs are subject to change or discontinuation at any time without notice.

Refinancing to reduce total monthly payments may lengthen repayment term or increase total interest expense. Conforming ARM Loans - Conforming rates are for loan amounts not exceeding $548,250 ($822,375 in Alaska and Hawaii). Adjustable-rate loans and rates are subject to change during the loan term.

Annual Percentage Rate calculation is based on estimates included in the table above with borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable. If the down payment is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR. Adjustable-rate mortgage loans and rates are subject to change during the loan term. If the borrower-equity is less than 20%, mortgage insurance may be required, which could increase the monthly payment and the APR.

"Is refinancing worth it?" is a question many homeowners ask when mortgage interest rates are low. Mortgage refinances often require you to complete a new application, provide a new set of income and financial documents, and pay closing costs. You want the expense of refinancing to be worthwhile by significantly lowering your interest rate, lowering your monthly payment, or improving other terms of your mortgage. By refinancing, the total finance charges may be higher over the life of the loan.

Chart data is for illustrative purposes only, is based upon state loan assumptions and is subject to change without notice. Accuracy is not guaranteed and products may not be available for your situation. Estimated monthly payment does not include taxes and insurance which will result in a higher monthly payment. For borrowers with less than 20% equity, mortgage insurance may be needed which could increase the monthly payment and APR. It's a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. Your actual rate may be higher or lower than those shown based on information relating to these factors as determined after you apply.

When rates dip or your personal finances change, it could be a good time to refinance your mortgage. Depending on your situation, you might use a new mortgage to get cash out or to gain a lower interest rate with lower monthly payments or a shorter term. Your KeyBank mortgage loan officer will talk you through all of your options, so you'll always know exactly what to expect. A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change.

And if interest rates drop to below your current rate, you can refinance to a lower rate. A mortgage's "term" is the number of years you have to pay the loan back. When you refinance with a new lender, you often have to pick a term of either 15 or 30 years. Refinancing to a 15 year mortgage might increase your monthly payment, but may help you save money on interest. At Freedom Mortgage, we are often able to allow our current customers to keep their remaining loan term the same when they refinance with us. The mortgage refinance rate we may be able to offer is personal to you.

Your interest rate is affected by the type of refinance loan you want, your credit score, your income and finances, as well as the current mortgage market environment. Freedom Mortgage may be able to offer you a refinance rate that is lower - or higher - than the rate you see advertised by other lenders. Nearly all types of refinance loans fall under the "rate and term" category, which is simply when either the rate or repayment term on your mortgage is changed. Typically, you're replacing your existing loan with one that has a more favorable interest rate or terms.

A longer loan term will have smaller monthly payments, but you'll pay more interest over the life of the loan. A shorter term loan will have a lower interest rate, but a higher monthly payment. Looking to have your payment stay the same for the entire loan term?

With a fixed rate conventional loan, you'll have peace of mind knowing your monthly principal and interest payments will remain exactly the same, for the life of the loan. Fixed-rate loans are available in 10, 15, 20, and 30 year terms, with options to eliminate mortgage insurance. The rates shown above are the current rates for the purchase of a single-family primary residence based on a 60-day lock period. Your rate will depend on various factors including loan product, loan amount, loan purpose, credit profile, property value, occupancy, and other factors. Mortgage insurance may be required, depending on loan program and the amount of the loan in relation to the property value, which could increase the monthly payment and APR. The rates shown below are today's the current rates for the purchase of a single-family primary residence based on a 60-day lock period.

How much you pay in closing costs when you refinance depends on your personal finances, the type of mortgage you choose, and your lender. Closing costs can include lender fees, discount points, and payments for homeowners insurance and property taxes. Freddie Mac says the average closing costs for a refinance are nearly $5,000. The actual amount of your closing costs may be higher or lower than this average. To determine whether it makes sense for you to pay discount points, you should compare the cost of the discount points to the monthly payments savings created by the lower interest rate. Divide the total cost of the discount points by the savings in each monthly payment.

This calculation provides the number of payments you'll make before you actually begin to save money by paying discount points. A Cash-Out Refinance is a mortgage refinance that allows you to access equity in your home. And instead of adding another monthly payment to your list, you'll only have to make one — your regular mortgage payment. All monthly payment amounts above assume on time monthly payments each month for the full duration of the loan term (e.g. 360 monthly payments for a 30 year loan). Displayed monthly payment amounts do not include amounts for property taxes and hazard insurance.

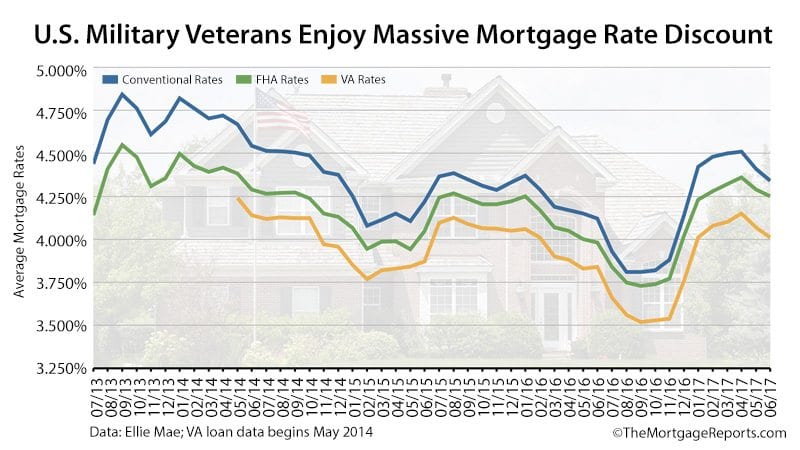

"Conforming thresholds" depend on the county where the property is located. These loans are provided to Americans who have a low to middle income. This loan is available to those people who cannot afford a large down payment or higher interest rates. Interest rates for these loans are lower than the national average for a fixed rate loan. Individual banks determine the interest rates; therefore, the consumer should do research prior to accepting a loan at a particular bank.

The consumer can receive a loan for as little as 3 percent down and also receive as much as 6 percent on closing costs. This means that the consumer can borrow up to 97 percent of the cost of the home. We receive current mortgage rates each day from a network of mortgage lenders that offer home purchase and refinance loans. Mortgage rates shown here are based on sample borrower profiles that vary by loan type.

The length of your loan's repayment term will also impact your refinance rate. Shorter term loans have lower rates than longer repayment terms, all else being equal. Ideally, your new refinance loan won't be adding years onto your mortgage, but you can also pay off your mortgage more quickly with a shorter loan term.

The downside is that shorter repayment terms will increase your monthly payment, so you'll need to be able to fit a bigger mortgage payment into your budget. NerdWallet's mortgage rate tool can help you find competitive mortgage rates. Specify the property's ZIP code and indicate whether you're buying or refinancing. After clicking "Get Started," you'll be asked the home's price or value, the size of the down payment or current loan balance, and the range of your credit score. You'll be on your way to getting a personalized rate quote, without providing personal information.

From there, you can start the process to get preapproved with a lender for your home loan. Money's daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available for. Today, we are showing rates for Wednesday, September 29, 2021. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points. An adjustable rate mortgage is a loan with an interest rate that fluctuates based on a publically-available interest rate index .

Many adjustable rate mortgage loans have a fixed interest rate period, typically 3, 5, 7, or 10 years. After the fixed rate period has ended, your interest rate can go up or down depending on the interest rate index in effect at that time. So why do people bother to refinance if it's such an investment of money and effort?

In many cases, it's to pay a lower interest rate on their home loan. But getting a lower refinance mortgage rate is not the end goal in itself. That means more room in the homeowner's budget, less money paid to the lender and more equity more quickly. Hybrid Adjustable Rate Mortgages offer the consumer a low interest rate for a certain period of time. Then, they increase or adjust to the current rate after fixed rate period has elapsed.

These rates can be an entire point lower than 30 year fixed rates. Therefore, there may be significant savings in terms of interest paid to the lender. Some common hybrid ARMs are 1 year fixed, 1 year adjustable rates (1/1); 5 years fixed, 1 year adjustable (5/1); and 7 years fixed, 1 year adjustable (7/1).

The adjustable rates will be based upon the federal rate when the fixed term elapses. These loans are also appealing to investors or home buyers who plan to sell in a short period of time. Today's 20-year mortgage refinance rates sank to a record low of 2.375% — rates for this term have only been this low one other time, in July. Homeowners looking to refinance should act quickly to lock in this low rate, which could allow them to keep their monthly payment manageable while seeing significant interest savings. Jumbo rates are for loan amounts exceeding $548,250 ($822,375 in Alaska and Hawaii).

Conforming Fixed-Rate Loans - Conforming rates are for loan amounts not exceeding $548,250 ($822,375 in AK and HI). See our current mortgage rates, low down payment options, and jumbo mortgage loans. Refinancing your mortgage can help you in a number of ways.