Apple's fourth and final stock split to date happened on 9 June 2014. This was the most significant of Apple's stock splits, with a seven-to-one ratio taking shares from close to $700 down to around $100. Apple wanted to make shares accessible to more investors, but it's also speculated that they set their sights on inclusion in the Dow Jones Industrial Average index. This index acts as a benchmark, with 30 stocks included from key economic sectors. As it's a price weighted average, Apple's stock price needed to be reduced before it was feasible for the company to be added. It was announced that Apple would join the Dow Jones in March 2015 and it has been a part of the index since March 2019.

The second Apple stock split took place on 21 June 2000, and was also a two-for-one split. Ahead of the split in May 2000, the stock price was $84. Shortly afterwards though, in September 2000, share prices were halved as many technology companies experienced a rapid decline. This was around the time the dot-com bubble burst, where many companies went out of business and others decreased in value. Apple blamed lower-than-forecast sales, as well as a weaknesses in the education market.

While Apple was affected temporarily, the company's shares made a full recovery and went on to achieve new highs. Apple's stock has split several times since it first went public in December 1980. The first split came on June 16, 1987, on a two-for-one basis at a pre-split price of $79. The next split came on June 21, 2000, when share prices reached $111. On Feb. 28, 2005, Apple split its stock again when it hit $90.

The company split its stock again on a seven-to-one basis on June 9, 2014, when share prices reached $656. The final stock split came on Aug. 28, 2020, when it split on a four-to-one basis at a pre-split price of $499.23. To be clear, stock splits do not change a company's underlying fundamentals. And though the lower-priced shares can attract smaller investors, larger investors already trading the shares can maintain more influence over the price action.

The overall market environment is key, as well, and it has influenced trading after the limited number of previous Apple stock splits. Apple is having a great year, and its4-for-1 stock spliton Monday is expected to make the market's most-valuable company even more attractive to a wider universe of retail investors. But the limited history of Apple stock splits says there is no reason to rush in to buy the lower-priced shares.

Apple's first stock split occurred on 16 June 1987, seven years after it became a public company, and it was a two-for-one stock split. It kept share prices low enough to make them accessible to investors. There was a 2% rise in stock prices over the following year. This is where split adjusted figures come in – they account for stock splits when working out return on investment.

With Apple, stock adjusted figures would acknowledge the fact that one stock bought during its initial public offering would now have become 56 shares. The company has previously split its stock four times when its shares have seen significant price increases, as highlighted in the table below. In the first three instances, stocks were split in two when the price was near triple figures. Then, in 2014, share prices rose sharply and a higher split ratio was used.

When looking at the value of a company's shares, it can be difficult to interpret how successful the company has been based on its stock prices following a split. Apple's current share price of around $408 doesn't look as impressive as it would have done ahead of its four stock splits. It seems unlikely that Apple will complete another stock divide in the near future. Share prices are still climbing (they are currently trading at around $186), however shares were worth close to $700 before the last split in 2014.

Apple may consider another stock split if share prices continue to rise, but for now, this move probably wouldn't be in the best interests of the company. Stock divides might not directly increase share prices, but they can often result in higher share prices further down the line. By making shares accessible to new investors, demand can increase, causing the share price to appreciate and the total market capitalisation to rise. Apple's financial performance, including its share price, relies heavily on the sales of its products.

A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion. It began trading publicly on Dec. 12, 1980, and this is the fifth split. The most recent one adjusted its share price from about $500 to $125. With the historical adjustments, previous events and prices will be changed. For instance, Apple priced shares in its 1980 initial public offering at $22 a shares.

After its first four stock splits, though, that price fell to 39 cents a shares in the historical register, and it will fall again — to about a dime — after this split. An investor buys a share in Apple in January 2005, so they have one share worth $77.00. After the two-for-one stock split a month later, they own two shares in Apple, but each of these shares is worth half the amount, at $38.50. If the shareholder keeps these two stocks until May 2014, they will be worth $1,266 ($633 each) as the stock price appreciates. With the fourth stock split, each of these stocks will then be split seven times, so that the shareholder owns 14 shares in Apple. The high valuations aren't just because of the stock split or the tech sector's big run in 2020.

Apple also continues to show strength in wearables, fueled by AirPods, Beats, and watches. That's because it enacted the four-to-one stock split to become "more accessible to a broader base of investors," the company announced after a knockout third-quarter earnings report. After Friday's closing bell, Apple shareholders are due the split shares for each existing share of the company that they own. Apple shares officially start trading at the new split-adjusted price at the opening bell of Monday's Nasdaq session. Apple announced its plan for the split on July 30 with its most recent earnings report. That underperforms the Dow Jones Industrial Average, which tends to be a coin flip in these post-Apple stock split weeks.

The Dow has eked out a positive gain, on average, trading in the green half the time. While a stock split might be carried out to encourage investment, the split in itself doesn't affect the market capitalisation of a company. Existing shareholders will own more stocks, but each of those stocks is worth less, so there is no change to the total market value of the company.

Large companies beat collective market expectations of their earnings to positively influence their market capitalization. It's no accident that they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices. As a result, earnings management is highly scrutinized by the Securities and Exchange Commission . In theory, stock splits like this one don't mean much.

If today you own 100 shares worth $500 each, on Monday you will have 400 shares worth $125 each. But it turns out that splits matter more than you'd logically think. Apple's upcoming stock split will see investors issued with four new shares for every one they currently own.

What Was The Price Of Apple Stock Before The Split The limited history of Apple stock splits shows that a short-term rally in shares has not been the result. Here's how shares have performed one year after its previous stock splits. Robinhood and other brokerages increasingly let customers buy fractions of individual shares, making the benefit of stock splits less obvious than in the past. Just three S&P 500 members announced splits in 2020, down from 12 in 2011, according to S&P Dow Jones Indices. Since I require a discount in the share valuations of my investments, my ratings are generally very conservative.

My valuation requirements, combined with the high quality companies that I often highlight, mean many stocks I rate as a hold perform well over the long term. Readers should consider this when weighing my buy/hold/sell recommendations. I seek a degree of safety in my investments by focusing on companies with competitive advantages and reasonable to strong balance sheets. That investor would own 22,400 shares worth $3,032,288. The annual dividends provide an income stream of $18,368 per year.

Although the chart above provides a share price of $293.65, that was the cost of the stock on the first trading day of the year. However, when the company announced the split , the stock was trading around $400 per share. A month later the shares split, and AAPL was trading at $645.57 per share. I provide an analysis of share price action following prior stock splits.

A transfer agent for a publicly held company keeps records of stock held by registered shareholders, including shares held in certificate form. When stock changes hands, the transfer agent updates the record of ownership of the stock. A stock split divides the original share price into smaller prices per share. A current Apple stockholder with one share will get three extra shares once the split occurs. (And one man inheriting 7,000 shares of Apple now has 28,000 shares.) Likewise, a current Tesla stockholder with one share will get four extra shares.

The release of an innovative, revenue-driving product or service is one of the few options a company has to influence its stock valuation. When Wall Street valuations are right or wrong, the reward or loss can be astronomical for investors. This is because accurately estimating the impact of an internationally distributed product on a company's earnings and the company's stock is a herculean challenge.

The stock market reflects all known information as stated by the efficient market hypothesis, processing and assimilating new data rapidly through the mechanism of buying and selling. The stock market is also forward-looking, which explains why a company's stock may fall, even when reported earnings improve from the previous quarter. Apple's stock history is a stellar example of how this works. Surged again on Monday as stock splits took effect and attracted more buying from investors. A review of historical data provides no clear cut target for a share price that would trigger a stock split. It does appear as if the odds of a new stock split increase as the share price reaches the $200 to $250 range.

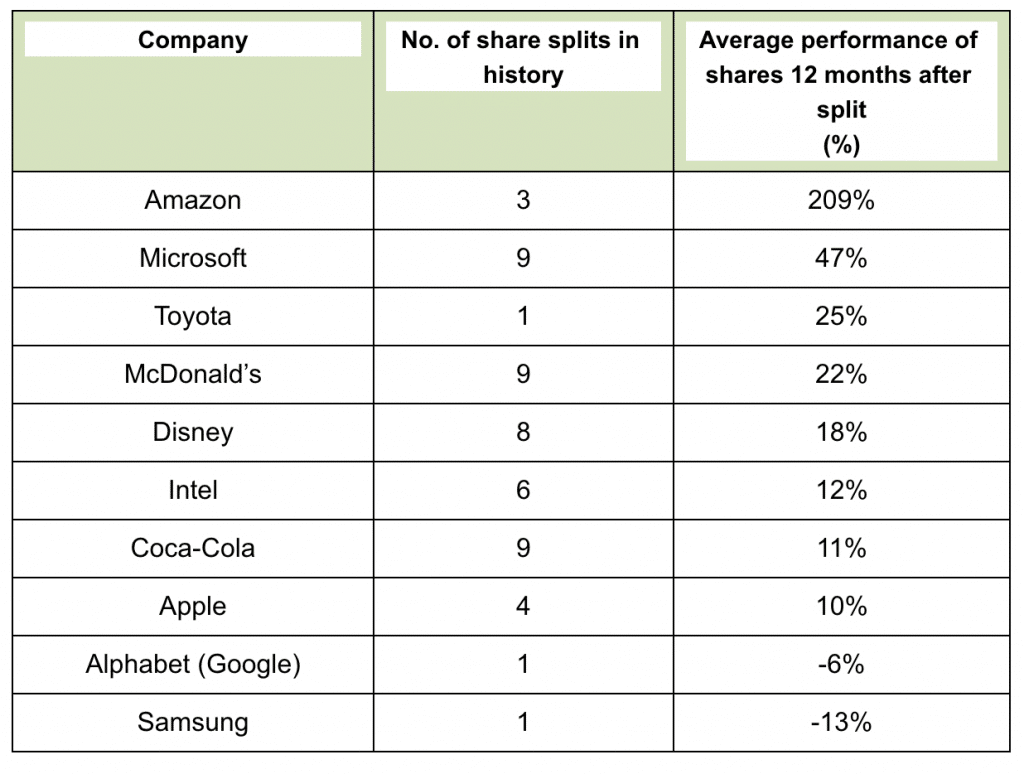

Apple's third stock split took place on 28 February 2005, with the company once again allocating a two-for-one ratio. This took the number of common shares authorised from 900 million to 1.8 billion, after shares almost quadrupled in value. While Apple has demonstrated generally strong returns following its stock splits over the years, not many companies have followed its path.

According to Ally Invest, fewer S&P 500 companies are splitting their stocks now than in the 1990s when it was all the rage. So how have shares of Apple performed after its previous stock splits? Here's how shares of Apple performed one year after its previous stock splits, according to Ally Invest. Apple completed its fifth stock split on Monday, as investors received four shares for every one share held. Apple split its stock 4-for-1, while Tesla split its stock 5-for-1, with both companies saying they aimed to make their shares more affordable to individual investors. The data has been revised since the last quarterly report.

For example, a month ago, revenue was projected to increase at an annual rate of 8.56% versus the current rate of 9.98%. Apple's stock has split five times since the company went public. The stock split on a 4-for-1 basis on August 28, 2020, a 7-for-1 basis on June 9, 2014, and split on a 2-for-1 basis on February 28, 2005, June 21, 2000, and June 16, 1987. A $1,000 investment in Apple on the day of the split was only worth $428 a year later. Investors who bought because of the split, without understanding Apple's fundamental business, may have sold at the worst possible time. Those who held on through the tech wreck and beyond have been rewarded.

That $1,000 investment would be worth nearly $113,000 today. Just seven Dow Jones Industrial Average components, including Apple, had share prices higher than $200 prior to the split. This information has been prepared by IG, a trading name of IG Markets Limited.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. While Apple has not given an official reason for 2020's split, it is likely that the company thinks that its high share price could deter new investors. Apple has announced a four-for-one stock split, which is set to take place on 31 August 2020. Here, we explain what this means for investors and take a look at Apple's stock split history. While the split is designed to lower the nominal price per share, split-adjusted Apple stock has a history of short-term sell-offs.

The company's fifth stock split could encourage new investors to buy, but Apple's trading history offers a warning. Investors received four shares for every one share held, resulting in its stock price being quartered — from about $500 last week to about $125 on Monday. In the past, it has been difficult for me to invest in rapidly growing companies.

My years of investing molded me into an inveterate value investor that seeks a margin of safety. Investing in undervalued companies is a means to that end. Microsoft undeniably possesses the first three attributes. It is incumbent upon the individual investor to measure the degree to which the firm defines the fourth. Let us assume you invested in 100 shares of Apple on the first trading day of 1986. That would result in $2200 ($5236 adjusted for inflation) devoted to a company that would experience a variety of ups and downs over more than three decades.

I'm taking a detour here to use Apple's stock split history as an argument for a buy and hold investment strategy. Apparently, a surge in the stock precipitates stock splits. While there was a relatively low increase in share value in 2014, that followed four consecutive years of gains that ranged from 147% to over 25% per annum. Even adjusted for inflation, there doesn't appear to be a price that triggers a stock split, particularly when one considers the last two occasions when the shares split.